Reprinted from the Hotel Business Review with permission from www.HotelExecutive.com

Authored by Roger Allen, Group CEO, RLA Global with insights from Chris Graham, founder of Graham Associates and author of the acclaimed ’Branded Residences: An Overview’ industry report

Two years ago, we explored the booming private members' club sector in the article ‘Profiting from the Rise of Private Members Clubs’, highlighting how exclusivity and premium amenities were driving unprecedented membership growth globally. Fast forward to 2025, and the landscape has evolved dramatically. What began as a renaissance of traditional club culture has transformed into something far more sophisticated: integrated lifestyle ecosystems that blur the boundaries between hospitality, real estate, wellness, and community building.

The sector continues to offer attractive growth opportunities – forecasts vary, but all point to sustained growth in the coming years. Research by Growth Market Reports calculates that the global market will nearly double to $59.1 billion by 2033, growing at an annual rate of 7.2% from $31.7 billion in 2024. Overall spend on luxury goods and services, which can also correlate with demand for members’ clubs, will continue rising in 2025-27, albeit at a lower 2-6% rate compared to 18% in 2019-23, McKinsey predicted. Looking toward 2030, the luxury market will likely embark on a long-term positive trajectory, with a growing customer base, Bain & Co. forecast.

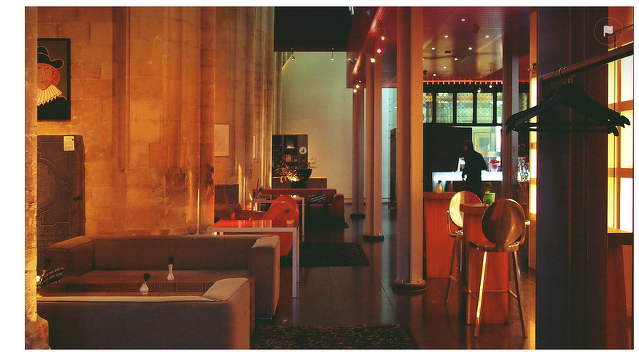

One thing is certain: today’s private members' club is no longer just a place to have lunch, network over cocktails, or play sport. It has become the cornerstone of a new luxury lifestyle philosophy, one that not only promises access to exclusive spaces populated by like-minded individuals, but comprehensively supports how affluent individuals choose to live, work, play, and connect.

However, this evolution brings unprecedented complexity. As clubs attempt to master multiple disciplines—from hospitality to healthcare, from real estate integration to intellectual programming—they face operational challenges that can make or break even the most well-funded ventures. Throughout our work with developers and operators, we've observed critical operational realities that demand specialized understanding to navigate these successfully.

The Branded Residence Revolution

A significant development in the sector has been the emergence of private members' clubs within branded residential developments. What started as an amenity add-on has become a core value proposition, fundamentally changing how luxury real estate is conceived, marketed, and priced.

In Dubai alone, where the ultra-wealthy population has continued its explosive growth, new residential towers are launching with private clubs as central selling points rather than afterthoughts. The Four Seasons Private Residences Dubai International Financial Centre doesn't just offer luxury apartments—it provides access to an exclusive members' club that serves as the social and business heart of the development. Similarly, Bulgari Residences Dubai has integrated club facilities so seamlessly into the residential experience that the boundaries between home and club have essentially disappeared.

New members-only clubs integrated into branded residences projects are also popping up in several other locations: E11leven Club Residences Beyond in downtown Miami will offer The Clayton exclusive club this year on the second level of its new 65-story residences structure. Design Hills Dolce & Gabbana Marbella in Spain will offer a private club with a cinema, bar and cigar cellar, while Auberge Resorts Collection will offer membership to the Moncayo Ocean Club to owners of the new branded residences at its Moncayo resort development in Puerto Rico.

While location remains paramount for affluent buyers when evaluating real estate, taking the community more into consideration has undoubtedly become a trend. Buyers aren't just purchasing a residence; they're investing in access to a curated lifestyle and often a social network that can appreciate alongside their property. We also see that many high-net-worth individuals tend to seek privacy in their holiday homes - more about that later.

The financial implications may be substantial, as branded residential developments with integrated members’ clubs could command premiums over comparable properties without club access. Even the proximity of an unrelated private club can drive property prices. Research by Knight Frank has found that demand for properties within a 15-minute drive of Soho Farmhouse in the Cotswolds region in England was more than twice the average for the area and attracted 2.3 times higher buyer interest in the summer of 2024. Properties within a mile of Soho Farmhouse – or other local private clubs – were sold faster than similar properties further away, it said.

The Integration Challenge: Beyond Amenity to Community

However, industry experts caution that successful club integration requires careful strategic consideration. Branded residential specialist Chris Graham notes that luxury residential buildings already function as "modern-day communities of like-minded people, with a sense of belonging to an exclusive members club," which therefore raises critical questions about differentiation and purpose, so developers must address some fundamental strategic decisions, e.g.:

- Is the club primarily for resident benefit or designed to attract external membership?

- Will residents receive free or discounted membership as a benefit of ownership?

- To what degree will homeowner management fees subsidize the club operations?

- What can a club offer to appeal to these like-minded, wealthy individuals to enhance their lifestyles?

These choices significantly impact both operational complexity and financial viability. The core challenge lies in competing with existing prestigious clubs to which wealthy residents already have access, while managing significantly higher staffing costs required for specialized club operations. The solution cannot be convenience alone – it must be programming that creates authentic community connections and engagement through exclusive experiences and events.

Critical to this is reimagining concierge services beyond traditional luxury amenities into community architects who actively facilitate member connectivity. This involves employing highly trained staff who know the member base well enough to add meaningful value, e.g. an introduction between a tech entrepreneur and a venture capitalist or arranging first viewing rights at major art auctions before public access.

But the value extends beyond internal connections. It's about curated human connections and privileged access rather than just booking limos and restaurants – creating a living network where members become valuable resources for each other while the club opens doors that remain closed to others. Club benefits should include exclusive access to partner events, high-end brands, and entertainment that individual members couldn't obtain independently.

Our strategic partner, Riyan Itani, Director and Founder of Global Branded Residences, observes: "By blending hospitality, wellness, workspaces, dining, and cultural programming under one roof, private members clubs provide a seamless mix of leisure and productivity. Members are drawn to the prestige of belonging, the networking opportunities, and the promise of a cosmopolitan yet intimate environment that feels both aspirational and personal."

Without strategic differentiation, developments risk creating expensive amenities that function as glorified residents' lounges rather than genuine lifestyle enhancement, failing to justify the substantial operational investment required.

The Longevity Economy Takes Center Stage

One transformative trend reshaping the private members’ club sector is the integration of comprehensive health and longevity services. The wealthy aren't just seeking exclusivity anymore, they're seeking longevity, and some clubs are positioning themselves as partners in this pursuit by offering access to advanced diagnostics, personalized medicine consultations, genetic testing, hormone optimization, and cutting-edge wellness protocols.

This isn't just about spa services anymore, it's about providing comprehensive health optimization programs that can cost individual members $50,000-100,000 annually. For clubs, this represents a significant new revenue stream that's largely recession-proof – after all, wealthy individuals will prioritize health investments even during economic uncertainty. Clubs like Sensei Lanai in Hawaii and the recently opened Remedy Place branches in New York and Boston have pioneered this approach, offering everything from cryotherapy and hyperbaric oxygen chambers to on-site functional medicine physicians and longevity specialists.

However, the substantial costs of offering such specialized equipment, along with highly trained staff to administer treatments, means that before embarking down this route a developer must thoroughly research the range of facilities to be offered, and the associated operating costs.

The integration of advanced health services also creates natural partnerships with medical tourism, executive health programs, and emerging longevity-focused real estate developments. Some clubs are even offering "health residencies" – extended stays that combine luxury accommodation with intensive health optimization protocols.

The Intellectual Renaissance

Progressing from the traditional networking-focused model, today's private members' clubs are increasingly positioning themselves as intellectual communities, responding to a growing desire among individuals for meaningful connections and continuous learning. Today's professionals seek varied, cross-disciplinary networks that create broader opportunities and experiences rather than industry-specific connections.

This shift means members want access to exclusive lectures, thought leaders, innovation labs, and peer-to-peer learning opportunities. Therefore clubs are investing heavily in programming that brings together diverse expertise across technology, finance, arts, and social impact. For example, The Core Club in New York now hosts regular "Future Sessions" where members engage with leading thinkers on emerging trends that will shape the next decade.

This intellectual focus is also important for attracting younger members. Wealthy Millennials and Gen Z individuals are less impressed by traditional status symbols and more drawn to experiences and communities that offer learning, growth, and purpose. They want to be part of something that enhances their capabilities and expands their perspectives, not just their social calendars. Meeting this demand and implementing intellectual programming can not only create deeper member engagement and reduce churn, but may also justify premium pricing at private clubs.

Privacy as the Ultimate Luxury

In an era of constant connectivity and diminished privacy, private members' clubs have become sanctuaries where the wealthy can exist without constant scrutiny. This focus is particularly valuable for international business leaders, celebrities, and political figures who face constant public attention. The ability to meet, work, and relax in a completely secure environment has become a key differentiator for premium clubs.

This goes far beyond traditional discretion—modern clubs are implementing sophisticated privacy protocols that rival those of government facilities. Advanced security systems, non-disclosure agreements for staff, phone-free zones, and even signal-blocking technology in certain areas are becoming standard features. Some clubs even offer "digital detox suites" where members can conduct sensitive business or personal conversations without any risk of electronic surveillance.

The Business Hub Evolution

The traditional "meeting room" concept has evolved into sophisticated business ecosystems within clubs. Post-pandemic, clubs have become convenient city drop-in spaces offering workspace, luggage storage, casual and formal dining, meeting facilities, and health amenities that align with modern working practices while eliminating the need for inflexible permanent office space. These modern facilities now include podcast studios, video production capabilities, private trading rooms, and co-working spaces designed specifically for high-net-worth individuals.

Clubs responded by creating business environments that rival corporate headquarters, complete with advanced technology, concierge support, and absolute confidentiality. The 12 Hay Hill in London offers luxury serviced offices within the private members’ club, with amenities and services including private offices accessible 24/7, a fully staffed reception, optional call answering, high-speed internet, audiovisual and conference call facilities, meeting rooms, and room service. Occupants also have access to the club’s roof terrace, bar, restaurant and co-working business lounges. In another example, The City Club of San Francisco offers private office suits with mail and package reception services, a dedicated concierge, in-house food and beverage options and a 24/7 security service for a protected work environment.

Some clubs can generate 30-40% of their revenue from business services, including private office rentals, event hosting, and specialized business support services. This diversification has proven particularly valuable, as it creates multiple touchpoints with members and generates revenue even when traditional social activities are limited.

The Generational Shift

Perhaps the most significant change since the pandemic has been the dramatic shift in the demographic profile of private club members. The stereotypical older, conservative club members are being rapidly replaced by younger, more diverse, and more internationally minded individuals.

This new generation brings different expectations. They want technology integration, sustainability initiatives, social impact programming, and global connectivity. They're less interested in traditional hierarchies and more focused on value creation, both for themselves and their communities.

Clubs that have successfully adapted to this generational shift report 60-70% of new members are under 45, with significant representation from technology, finance, and creative industries. These younger members also tend to spend more on additional services, making them particularly valuable from a revenue perspective.

The Exclusivity Dilemma: Will Higher Membership Dilute Appeal?

One of the major selling points of private clubs has traditionally been exclusivity. Most clubs still limit membership, with many accepting newcomers by invitation only or based on recommendations from existing members.

With investor appetite for private clubs on the rise, it may become an increasingly pronounced question whether clubs can generate substantial growth in the long run without increasing the number of members, and if higher membership would dilute exclusivity and harm appeal. Discussions about this issue surfaced after the recent $2.7 billion acquisition of Soho House, perhaps the best-known private club chain globally, by a consortium led by US hotel chain MCR and involving actor/investor Ashton Kutcher. Financial and industry advisors told the BBC that the new owners may have to deal with concerns about Soho House’s rapid expansion and changing membership rules, which made some members feel that the brand “has been diluted” and “less exclusive”.

The Risks of Overexpansion: When Ambition Exceeds Execution

When it comes to services, the challenge for private clubs lies not in offering comprehensive amenities, but in selecting the right mix that creates genuine competitive advantage. The risk is falling into the "Swiss Army knife trap"—offering numerous services while mastering none. Developers often underestimate the importance of understanding their target audience landscape—the specific demands, preferences, and behavioral patterns that drive membership decisions in their particular market context.

From a supply-side perspective, the decision becomes even more complex. Each amenity category requires different investment levels, operational expertise, and ongoing maintenance costs.

The key insight is that wealthy members don't simply count features—they evaluate the overall experience quality and how well it aligns with their lifestyle priorities. Success demands deep understanding of both member psychology and operational realities, ensuring that chosen amenities complement rather than compete with each other for resources and management attention.

The Operational Challenge: Why Most Fail Before They Begin

The evolution toward multi-service private members’ clubs has created unprecedented operational complexity that catches most developers unprepared. Recent industry data shows member resignation rates increased by 63% in 2023 while new membership enquiries declined by 50% from 2021—metrics that often reflect operational breakdowns rather than market weakness.

In our experience working with club developments, we consistently observe three critical areas where projects encounter unexpected challenges:

- Regulatory and Operational Incompatibility

The fundamental challenge here is that different service areas operate under entirely different regulatory universes:

- Healthcare components must comply with medical licensing and HIPAA requirements.

- Business facilities need security clearances and financial privacy protocols.

- Hospitality elements require food safety and liquor licensing under completely different oversight bodies.

In short, what appears as a unified club experience to members actually represents multiple businesses with conflicting operational requirements, incompatible technology systems, and regulatory frameworks that often work against each other.

- The Talent Shortage

As we see, the expertise required for these complex operations simply doesn't exist in the traditional hospitality talent pool:

- Hospital administrators understand healthcare compliance but lack hospitality service standards.

- Country club operators excel at member relations but cannot navigate sophisticated business center technology.

The multi-disciplinary leadership needed to seamlessly integrate healthcare professionals, hospitality teams, technology specialists, and security experts represents a fundamentally new skill set that the industry is still developing.

- Financial Complexity Beyond Traditional Models

Managing the financial performance of multiple business models under one roof creates extraordinary complexity. Each revenue stream has different cost structures, member usage patterns, and profitability timelines that require sophisticated financial modeling and management approaches far beyond traditional club operations:

- Healthcare services generate steady year-round revenue while social programming peaks seasonally.

- Business facilities show high weekday utilization but remain empty weekends.

Understanding these realities during initial planning—rather than discovering them during implementation—often determines project success or failure.

Looking Ahead: Strategic Imperatives for the Next Decade

The private members’ club industry stands at an inflection point where traditional hospitality expertise alone will no longer suffice. Strategic success will require mastering the integration of multiple complex ecosystems: seamlessly connecting residential value with club amenities, creating intellectual communities that attract younger, globally minded members, and delivering privacy and security standards that rival diplomatic facilities.

The operational complexity we've discussed isn't diminishing—it's accelerating. The development teams that recognize this reality and build accordingly will define the industry's future.