Southern Europe attracted great attention at the International Hospitality Investment Forum (IHIF) in Berlin this April, where participants heard about opportunities in this region – including Mediterranean markets with a long experience, such as Greece, and emerging hot destinations, like Albania. Inspired by these discussions, we take a closer look at trends and prospects in this high-growth region.

The year of breaking records

Southern Europe was the only major region in the continent where international tourism exceeded pre-pandemic levels in 2023, UN Tourism, formerly UNWTO, has estimated. The region received over 307 million foreign tourists last year, up from 266 million a year earlier and 304 million in 2019.

International arrivals in Spain rose by 18.7% on the year to 85.1 million last year – the highest since the country’s statistical records began. Greece also broke a record with 32.7mn foreign tourists in 2023, up by 17.6% from 2022, while Türkiye attracted 49.2 million foreign visitors, a 10.4% rise from 2022.

Smaller countries also had an exceptional year. Malta, Cyprus and Croatia saw the number of inbound tourists climb by 30.1%, 20.1% and 10% to 3 million, 3.8 million and 16.9 million, respectively. Albania had 35% growth to 10.1 million last year. It was ranked number four globally in terms of percentage increase in international arrivals, with a whopping 56% rise compared to 2019, UN Tourism said.

Hotel occupancy and ADR up

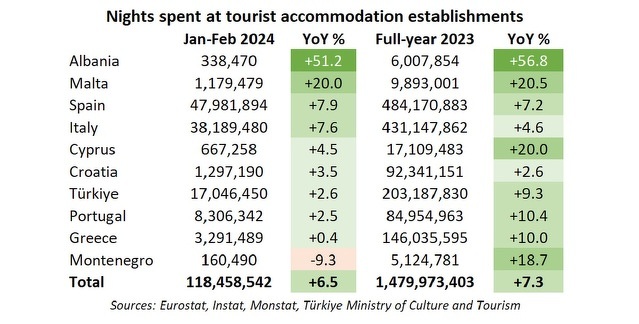

More arrivals translated into more business for local accommodation providers. The total number of guest nights by foreign and domestic visitors in ten countries across the region was up by 7.3% in average at nearly 1.5 billion combined last year.

Albania was again an outlier with a massive 57% growth, followed by other smaller destinations, Malta, Cyprus and Montenegro, each recording a 19-20% increase. Bigger markets had single-digit growth, except for Portugal and Greece, each with 10%.

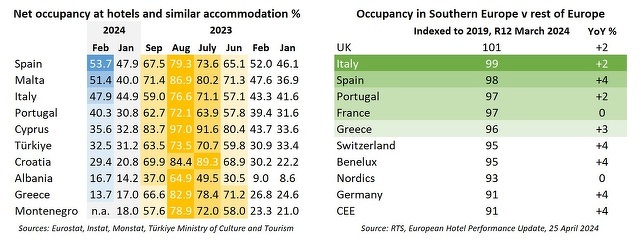

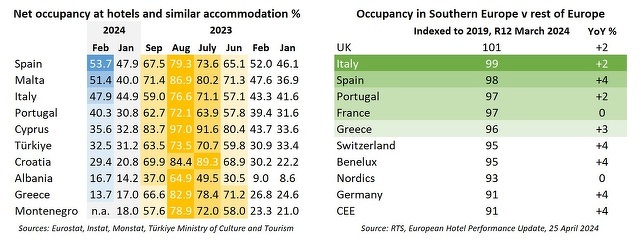

Albania also boosted net hotel occupancy in January and February, but was still way behind most of the bigger markets. Southern Europe’s recovery in occupancy was faster than in most other European regions in the rolling 12-month period to March 2024.

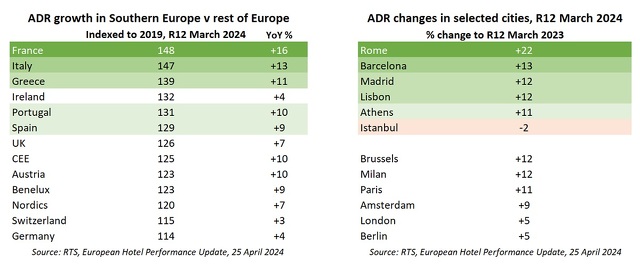

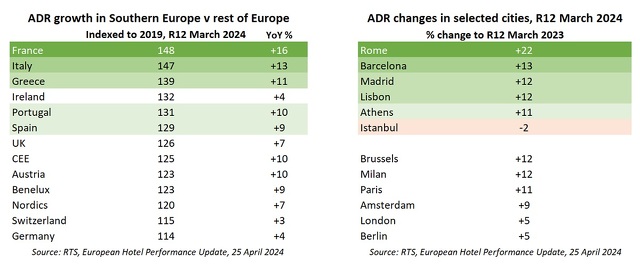

The region was also well ahead in terms of ADR increase in the rolling 12-month period to March 2024. Most gateway cities in Southern Europe had two-digit ADR growth, except for Istanbul, where Turkey’s economic challenges impacted ADRs, according to STR.

Participants at IHIF also said ADRs across Southern Europe are back at 2019 levels, cities are growing and resorts offer great opportunities in the premium segment – especially in Greece, which is a well-developed destination that increasingly attracts high-net-worth visitors.

Cultural offerings on the rise

Southern Europe’s appeal goes well beyond the sun and the beach, local destinations also offer outstanding cultural experiences. Leisure travelers have a wide variety of options, ranging from visiting world heritage sites and archeological museums to marveling at art collections in buzzing historic cities or participating in customized wine tours in rural areas.

The Mediterranean cuisine and local culinary experiences have always been a big draw for visitors to Italy, France or Greece, among others, and continue to contribute a great deal to hospitality revenues. In an example, shared at IHIF, local restaurants stimulate leisure business in Greece and can impact occupancy and overall hotel performance in certain areas.

Further away from the Mediterranean Sea, countries in the Western Balkans offer new opportunities for active and adventure travel. The Via Dinarica long-distance hiking trail stretching from Slovenia to Albania is getting discovered in Australia, while lesser-known Kosovo’s mountain canyons and Ottoman and Byzantine heritage are making headlines in the UK.

Attractive all year around

Hotel markets in Southern Europe tend to have strong seasonality, but hotel occupancy was up on the year in January-February 2024 in several countries, including Spain, Malta, Italy and Albania.

UN Tourism has estimated that the number of international tourist arrivals in the region as a whole was up in each quarter of 2023 from a year earlier and from 2019 as well, which potentially indicates an uptick in business travel.

About 32% of European respondents said in a recent Accor survey that they will take a holiday outside the peak season in 2024 to reduce costs, while 19% said they would do so to avoid heat waves. This could potentially lengthen the peak season in Southern Europe.

A magnet for US travelers

Southern Europe benefited greatly from overseas demand in 2023, notably from the US. Türkiye had the fastest growth in Europe in terms of US arrivals, which were up by 136.5% last year from 2019, the European Travel Commission (ETC) said. Portugal, Serbia and Montenegro were also among the top performers in terms of US arrivals through 2023.

US demand may remain strong in the summer of 2024. Spain – which saw a 38.7% rise in US tourist arrivals and a 50% increase in US tourist spending in 2023 – has said that frequencies of direct flights and airline seats from the US are forecast to increase by 16% and 17%, respectively, in June-September this year from the same period last year.

Chinese tourist arrivals in Europe were still well below 2019 levels in 2023 despite the country’s reopening to international tourism, ETC said. But its data show that the fall from pre-pandemic levels was the lowest in Serbia, Türkiye, Spain, Portugal and Romania. Serbia even managed to slightly raise Chinese guest nights, in a rare example last year.

Exchange rates boost value

Some destinations in Southern Europe have been cheaper than comparable countries, which has been key to attracting more price-conscious travellers, ETC said. The strongest recovery in arrivals tended to be in destinations which were more affordable in 2023, such as Türkiye and Bulgaria, and those popular for package holidays, like Portugal and Spain.

The Turkish lira weakened by 35% to the US dollar in 2023, and some analysts expect it to continue falling by up to 20-30% in 2024, which could support US demand.

But the region is also in demand in the high-end travel market. Travelers spending around €8,000 per trip in average selected Spain as their first choice for a holiday destination in 2024, ahead of France, Italy, Greece and the US, according to a survey by Condé Nast Johansens.

Top spots for hotel investors

Investor appetite is also prominent in Southern Europe’s hospitality sector. The Iberian Peninsula is currently the most sought-after market in Europe for hotel investors, followed by Italy, France, UK and Ireland, and the DACH countries, Cushman & Wakefield said in April.

Madrid and Barcelona top the list of European cities with the strongest investment interest, ahead of Paris, Rome, Lisbon and Amsterdam. Barcelona saw a 10% increase in attractiveness compared to 2022, the highest rise in the continent, followed by Lisbon with 8% and Madrid with 7%.

In terms of hotel development across the region, Türkiye leads with the biggest project pipeline, ahead of Greece, Romania and Albania, industry experts said at IHIF. Türkiye had a record-high 118 projects with 17,752 rooms in the fourth quarter of 2023, making it the fourth-biggest market in Europe in terms of development after the UK, Germany and France, data from Lodging Econometrics show. Istanbul was second among European cities – after London – with 53 hotels projects and 8,911 rooms.

Hotel operators have been quick to respond to the evolution of promising new markets in Southern Europe. There are 17 global hotel brands currently operating in Albania, none of which were present in the country just five years ago. Albania wants to position itself as a year-round tourist destination by 2030, supported by substantial investments in crucial infrastructure such as airports, marinas, and ports, UN Tourism said in its recently published investment guide for the country.

Promising outlook for 2024-25

Travel demand is generally expected to continue growing in Southern Europe in 2024-25, albeit maybe at a slower rate, according to ETC’s forecast. It said inbound visitor demand, based on the sum of overnight tourist arrivals, would rise by 9.4% on the year in 2024 and by 6.6% in 2025.

This is good news for countries in the region, which rely on tourism to generate a significant part of their GDP. Strong tourism performances contribute to Southern Europe’s current position as a driver of growth in the continent. It is already seen as “the workhorse of the post-pandemic European recovery”, with Italy, Spain, Portugal and Greece collectively outperforming Germany’s growth.