Despite the disastrous effects of the Covid-19 pandemic and difficulties caused by the war in Ukraine, the global accommodation industry continues to be massive in size. The hotel and resort sector is expected to generate a staggering $1.2 trillion in total revenue in 2023, up by 13.6% from $1 trillion last year, but still below the pre-covid high of $1.5 trillion in 2019.

This total income is generated by a large number of players. The number of businesses operating in the sector fell by 16% to 565,000 worldwide in 2021 from the pre-pandemic level of 671,000 in 2019, but market recovery drove this total up by nearly 19% on the year to 670,000 in 2022 and is foreseen to increase it by a further 8.6% to a whopping 728,000 during 2023. But these data suggest that enterprises operating in the accommodation sector are expected to generate less revenue on an individual basis in 2023 compared to 2019.

Economic contribution, labour

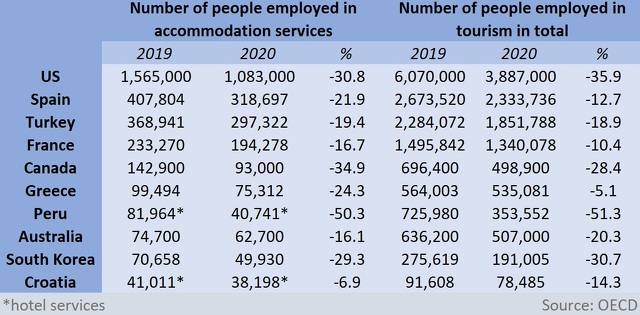

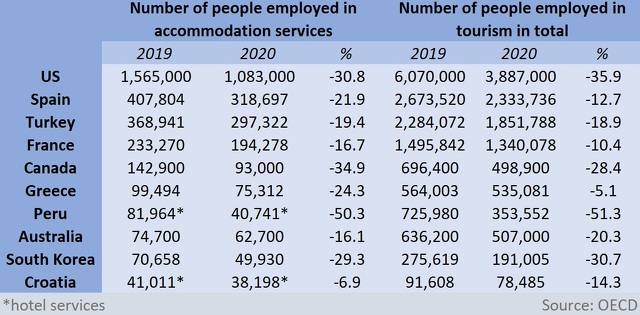

The hospitality sector, including hotels and restaurants, generates about 2-3% of GDP in the European Union. Its total workforce rose to around 11 million in the EU by 2019, but hundreds of thousands were dismissed in 2020 in the wake of the pandemic. As of September 2022, 10% to 20% of the workforce was still missing in the sector across the EU compared to 2019.

Labour shortages also cause a serious problem for hotels in the US, which lost almost 500,000 jobs in the accommodation sector in 2020. As of October 2022, employment was still 17.1% below pre-pandemic levels, putting this sector way behind other segments of tourism, such as food and beverages or air transportation. In spite of these difficulties, hospitality contributed with 3.1% to US GDP at end-September 2022, up from a previous share of just 1.9% at end-June 2020.

Market shares, top players

Estimations vary about how many hotels operate around the world in total. The 20 biggest chains manage over 91,000 properties globally, with more than five million keys combined at the five largest groups alone. Ranked by the weighted number of properties and rooms, Marriott is a clear market leader with around 8,000 properties and about 1.5 million rooms. It is followed by Hilton, OYO, Wyndham and InterContinental among the top five.

The top countries with the highest number of rooms available for accommodation were the US (5.4 million), India (2.5 million), Japan (1.6 million), China (1.2 million) and Italy (1.1 million) in 2019. Kiribati, one of the least visited countries around the globe, had just 391 rooms with 683 beds. The annual occupancy rates were the highest in Macao (91%), Guam (90%) and Singapore (87%).

Cities with the highest share of five-star hotels are Doha (51.43% of its hotels have five stars), Shenzen (28.95%), Abu Dhabi (28.43%), Marrakech (28.41%) and Shanghai (24.63%). As of last June, the most affordable five-star hotels operated in Kuala Lumpur, Ho Chi Minh City and Bangkok. Near the other end of the spectrum are budget hotels, more than half of which operate Vin the US.

High-end hotels may better withstand economic difficulties because they traditionally find it easier to increase prices to offset higher costs as their guests tend to be less price-sensitive. The pandemic expanded the group five-star hotels can target: the number of ultra-high-net-worth individuals with a wealth of over $50 million climbed by 89,400 to 264,200 globally in 2021 from 2019.

Performances, new openings

General hotel demand largely bounced back to new highs in the summer of 2022. Global occupancy averaged 67% in July-August, surpassing 64% in the same period of 2019. RevPAR in July exceeded 2019 levels in Europe (€159) and the Middle East ($116) and came close to pre-pandemic levels in the US ($154). GOPPAR in July rose sharply in Europe (€94) and the Middle East ($62) but was still below 2019 in China ($34.5) and the US ($82), albeit just slightly.

Room demand in the US rose to an all-time high in the winter holiday season of 2022, with RevPAR mostly above 2019 levels. Occupancy around the globe still trailed 2019 levels during the last week of December 2022, but was up by 7 percentage points on the year at 56.1%. Some major markets, such as France, Spain or Mexico, recorded higher occupancy rates than in 2019. Average RevPAR in non-US markets rose by 52% on the year to $106 at end-December.

Both chains and independent hotels benefited from market recovery in 2022, at least in Europe, although only 48% of local independent operators reported an increase in ADR, which compared with 57% for chains. Fewer independent hotels saw their occupancy rate rise (56%) compared to chains (65%). A significant minority (36%) of European hotels had a neutral perception of the economic situation, which may show many operators are cautious or uncertain.

Developers have a robust project pipeline globally, although activity slowed down in recent months due various economic factors, such as higher interest rates or concerns about recession.

The number of new hotel openings are expected to increase in all major markets in 2023, with the biggest growth forecast in the Middle East and China. As of end-September 2022, cities with the largest development pipeline included Chengdu, Shanghai, Guangzhou and Hangzhou in China and Riyadh, Doha, Jeddah and Makkah in the Middle East. Overall, operators were foreseen to open more than 2,200 new hotels with over 350,000 rooms combined in six key markets in 2023.

Outlook, customer sentiment

The recovery of international hotel bookings from the US and Europe slowed down in the last quarter of 2022, probably as the cost-of-living crisis, increased energy costs and higher inflation impacted travel decisions. International bookings from the US fell to 13.5% of total volumes by end-December 2022 from 16% at end-September 2022. European international bookings stood 3.5% below 2019 levels at the end of last year, down from just 1% at the end of the third quarter 2022.

Hotel demand from Chinese tourists will likely rise as China began rolling back Covid-19 restrictions for the first time since the pandemic started. About 18 million are expected to travel internationally in the first half of 2023, rising to 40 million in the second half of the year, which would be still significantly below the 155 million in 2019. Some destinations have re-introduced Covid-19 restrictions or requirements for Chinese tourists, which might have a negative impact on arrivals.

The net propensity to travel in the future stood at +23% for domestic and +20% for international travel in November 2022, down from +29% and +27% in July 2022. Consumers may be currently prioritizing travel more, which could point to a more positive short-term sentiment. Only 16% said they would travel less in 2023.

About 60% of US respondents said in December 2022 that they are likely to take more leisure or vacation trips in 2023 than a year earlier, and perhaps more importantly, 60% are more likely to stay at a hotel compared to 2022. In another new survey, about 3 in 4 international respondents said inflation will impact their future travels, while 22% still mentioned Covid-19 as a concern. Only 7% said they wouldn't travel to Eastern Europe because of the ongoing war in Ukraine.

Digital and sustainability transformation

In addition to addressing possible concerns about the current economic situation, accommodation providers also need to advance their digital and sustainability transformations. About 59% of operators in Europe saw their preparedness for digital transformation good or very good in 2022, but only 2 in 5 considered themselves up to speed when it came to sustainability-related challenges. Unsurprisingly, 50% said energy efficiency was the most important topic in this latter field.